Japanese Candlestick Trading :- The Japanese created their own technical analysis to trade rice. That’s right, rice.

A Westerner by the name of Steve Nison “discovered” this secret technique called “Japanese candlesticks,” learning it from a fellow Japanese broker. Steve researched and study candlesticks, and began to write about it. Slowly, this technique popularity in the 90’s.

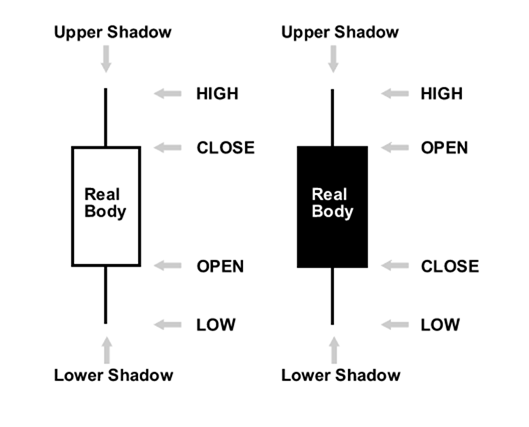

Japanese candlesticks can be used for any market time frame, whether it be one day, one hour, 30-minutes – whatever you want! They are used to describe the price action during the given time frame.